Strong operating performance

31/10/2019

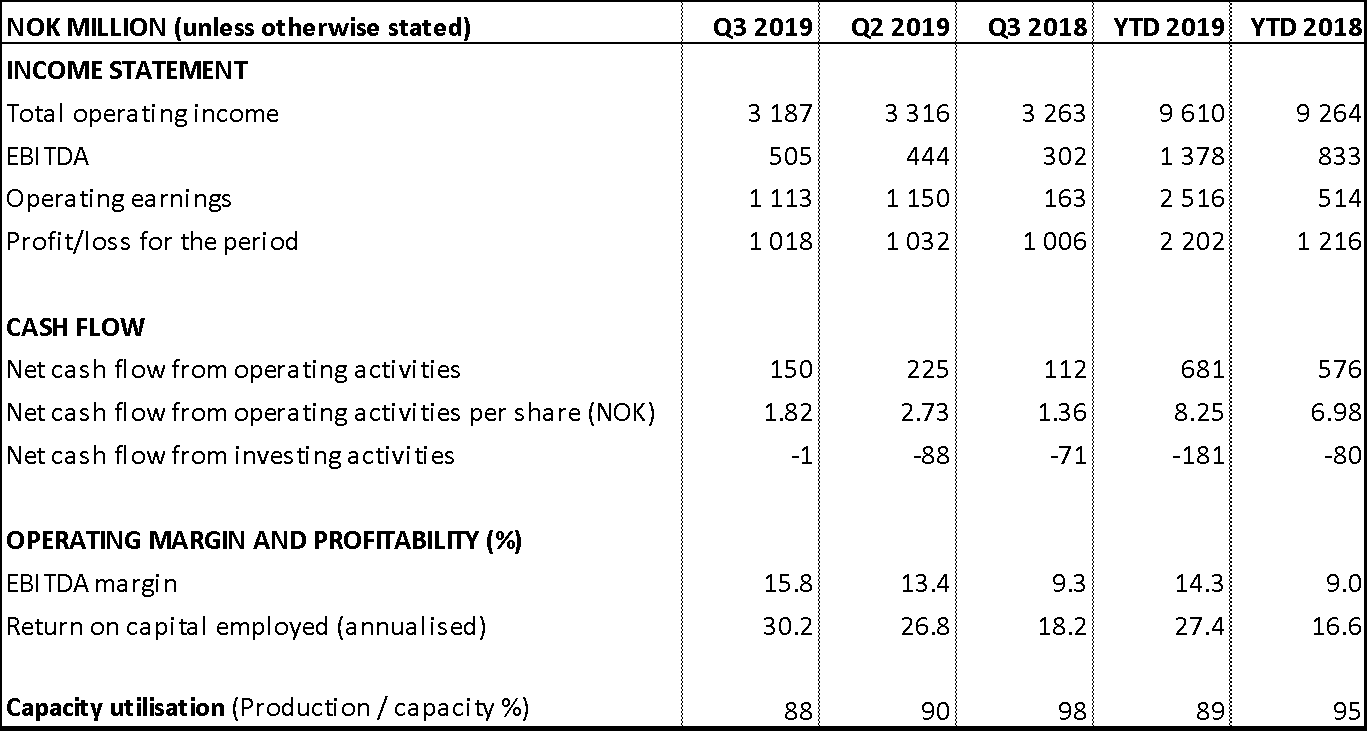

Norske Skog’s EBITDA in the third quarter 2019 was NOK 505 million, an increase from NOK 444 million in the second quarter 2019. EBITDA was impacted by a gain on sale of water rights at Albury and CO2-compensation granted for Norske Skog Saugbrugs. The sales volumes and sales prices in Europe were slightly down in the third quarter. Less domestic demand in Australasia resulted in more low-margin export sales from the region.

- After a successful stock exchange listing, I am very pleased to present a financially robust company generating a solid financial performance despite challenging market conditions, especially for the Australasian mills. Also, the sale of the Albury mill will substantially strengthen our cash position and reduce our market exposure to the Asian low-margin markets from 2020, says Sven Ombudstvedt, CEO of Norske Skog.

Operating earnings in the third quarter were NOK 1,113 million compared to operating earnings of NOK 1,150 million in the second quarter of 2019. Net profit in the third quarter was NOK 1,018 million compared to a net profit of NOK 1,032 million in the second quarter 2019, mainly due to non-cash changes in the valuation of elements in energy contracts. Cash flow from operations declined to NOK 150 million in the quarter from NOK 225 million in the second quarter, mainly due to change in working captial as a result of Saugbrugs’ CO2-compensation, which will be received in 2020. Net interest-bearing debt is NOK 852 million at the end of the third quarter, with an equity ratio of 55%.

Key figures, third quarter of 2019

The Albury sale

The Albury mill will cease newsprint production by the end of the fourth quarter 2019. The sale of the Albury mill and realization of certain other related assets, including energy and water rights, will generate net cash proceeds of approximately NOK 700 million. The regional Australasian management has started a process to handle the redundancy. Norske Skog will pay redundancy payments and transaction costs of approximately NOK 215 million following the sale.

Segment information

Total annual production capacity for the group is 2.6 million tonnes. In Europe, the group capacity is 1.9 million tonnes, while in Australasia, the capacity is 0.7 million tonnes, where the Albury mill has 0.3 million tonnes.

Europe

Operating revenue decreased from the previous quarter with lower sales volumes and sales prices. Variable costs per tonne decreased in the third quarter, especially impacted by the recognition of CO2-compensation for Saugbrugs. Fixed costs were slightly decreased. According to Eurograph, demand for newsprint in Europe decreased by 6% through August this year compared to the same period last year. SC magazine paper demand decreased by 10%, while demand for LWC magazine paper declined by 12%. Our capacity utilization was 90% in the third quarter, unchanged from the second quarter.

Australasia

Total operating income increased from the previous quarter due to the sale of water rights in connection to the sale of Albury. Sales volumes were in line with previous quarter but the EBITDA was negatively impacted by Asian low-margin volumes. Both variable cost per tonne and fixed costs were relatively unchanged in the quarter. According to official trade statistics, demand for newsprint in Australasia declined by 8% through September this year compared to the same period last year. Demand for magazine paper declined by 1%. Capacity utilisation was 81% in the period.

Outlook

The market balance for publication paper in Europe is supported by the announced capacity closures and conversions in the industry. Prices have declined into the third quarter and current price levels are expected into the coming quarter. The impact of the decrease in sales prices is to a large degree offset by decreased input cost from energy, pulp wood and recovered paper.

Following the cessation of newsprint at Albury in Australia in December 2019, the current export of production in excess of domestic consumption will be significantly reduced from its current level. This will reduce the region’s exposure to the volatile and currently low priced Asian market as well as reduce the currency exposure in the region. Driven by regional delivery optimisation and reduced exports, we expect regional EBITDA to improve by approximately NOK 80 million in 2020.

Norske Skog will continue its work to improve the core business, convert certain of the Group’s paper machines and diversify the business within bioenergy, fibre and biochemicals.

About Norske Skog

Norske Skog is a world leading producer of publication paper with a strong market position in Europe and Australasia. Publication paper includes newsprint and magazine paper. The Norske Skog group has seven mills in five countries, with an annual production capacity of 2.6 million tonnes. Newsprint and magazine paper is sold through sales offices and agents to over 80 countries. The group has approximately 2,400 employees. In addition to the traditional publication paper business, new growth initiatives related to renewable energy, bio cheminal products and fibre products have been launced.

Live presentation and quarterly material

Investors and press are invited to the CEO’s presentation of Q3 results today 08:30 CET at MESH (Tordenskiolds gate 3, Oslo).

The CEO presentation, the quarterly financial statements and the press releases are available on www.norskeskog.com and published on www.newsweb.no under the ticker NSKOG. If you want to receive future Norske Skog press releases, please subscribe through the website of the Oslo stock exchange www.newsweb.no.

Norske Skog Q3 2019 reports and press releases

Norske Skog

Communications and Public Affairs